BROADCASTERS ATTRACTING NEXT GENERATION

Broadcasters are “constantly thinking about how to push [their] brand past its traditional boundaries to meet new viewers” with QR codes, TikTok, YouTube Shorts, and more are being used to connect with them. Broadcasters are also focusing on creating engaging content that resonates with younger viewers. For example, FOX added QR codes with offerings to make their game shows more interactive. Others are incorporating social media and user-generated content into their broadcasts to create a more interactive experience. According to one programming development lead, they’re working with sponsors to increase audience “hyper-engagement” and drawing in viewers with opportunities to play and win at home. (TVNewsCheck: 4/20/23)

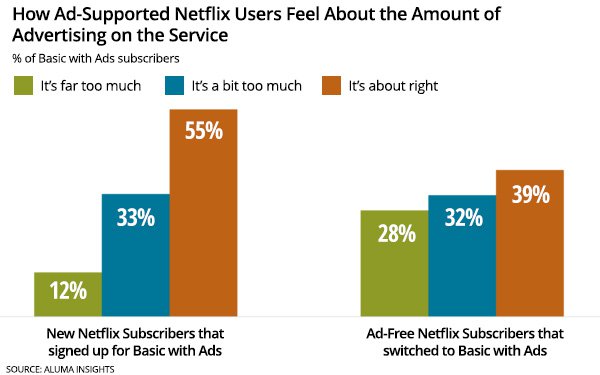

NETFLIX AD OPINIONS

Although Netflix’s ad options are similar to other services, consumers find the ads to be “too much.” 49% of new “Basic With Ads” subscribers feel that the ads are “heavy” and 17% found them to be “excessive.” Whereas existing subscribers feel that the ad component is okay. “Overall, about 40% of those who made the switch from Netflix’s standard ad-free service to the cheaper $6.99-a-month service say the advertising is ‘about right.’” (MediaPost: 4/25/23)

FAST SERVICES IN BLACK HOUSEHOLDS

According to a study from Horowitz Research, Black viewers are viewing FAST services and subscription video-on-demand in numbers higher than other consumers. “More than 80% of Blacks have used a free OTT service over the past month, up from 13% from 2019 and compared to 69% for consumers overall.” Also, 7 in 10 Black viewers subscribe to at least one SVOD service, mostly Netflix and Prime Video. “In addition, two in three Black subscribers to MVPD or vMVPD services give favorable ratings to their provider’s selection of channels geared towards Black audiences.” (NextTV: 4/18/23)

TV SPENDING

According to a recent survey from iSpot, 2023-24 TV spending plans from over 500 brand and agency professionals reveal that 74% expect to spend at least as much as they did last year and 21% expect to spend more. ”If spend isn’t going anywhere, then the coming upfronts should prove that TV continues to maintain its appeal, and if anything, looks even more valuable as a reach vehicle for a significant portion of buyers.” Some are looking into spending more with streaming platforms as “30% of respondents indicated at least a fifth of their upfront budgets will be allocated toward digital streaming platforms and nearly nine out of 10 respondents said at least 5% of budget would be utilized on streaming.” (TVRev: 4/19/23)

An article by Tess Erickson, Director of Strategy and Research at Broadbeam Media (Active’s Performance and Analytics arm), dives into the fragmentation of sports viewership and where to find them. Siting research from a recent Broadbeam study, “Thirty-three percent of our survey respondents reported that the driving reason for being loyal to one of these OTT services was live sports, with Linear+ options such as ESPN+, Peacock, and Paramount+ being their go-to channels.” Amazon Prime Video’s deal to stream “Thursday Night Football” was also a “game changer” as 20% reported streaming live which is up from 13% in 2021. Although the way viewers are watching sports has become fragmented with different services and channels, it’s still clear that viewers are interested in watching live sports. (SBJ: 4/19/23)