THE GROWING CASE FOR FAST CHANNELS

“The old, independent television business model” has taken on a 21st-century twist, now that “anyone with a device connected to the internet has free access to what seems like unlimited commercial video content.” Free ad-supported television (FAST) has attracted attention from manufacturers such as Samsung, Apple, and Amazon which pushed them to launch their own branded content applications. Also, companies Pluto TV and Tubi created platforms that were later purchased by Paramount and Fox as “their unique advantages are content from their individual parent companies and that they are device-agnostic.” FAST channels have a large advertising appeal as they made up for 4 of the top 10 streaming services in 2022 and offer a less cluttered environment. “S&P Global estimates $4 billion in 2022 U.S. FAST service revenues, growing approximately $9 billion by 2026.” (TVNewsCheck: 4/12/23)

BUSTING THE FAST CHANNELS MYTH

In contrast to the above article, some OEMs and media companies that own FAST services “are looking to cut the number of linear channels they have on offer, not grow them.” One red flag is the number of “Big Media” companies looking to make their shows available on FAST channels. Another cause for concern is the “mistaken impression that these aggregators are looking for out-of-the-box, pre-programmed channels.” According to research from Stream Metrics, “only 18% of FAST channels are from a single IP provider.” Services with the highest percentages of single IP channels are Freevee (32%), Peacock (28%), and Pluto (26%). It is likely that there will soon be 3 categories of FAST channels: single IP channels, curated channels, and personalized channels. (TVREV: 4/18/23)

NIELSEN IS RE-ACCREDITED BY MRC

The Media Rating Council announced that it has reinstated the accreditation of Nielsen’s national TV audience-measurement service. However, this reinstatement “does not include Nielsen’s “digital in TV ratings” (dTVR) component of its national TV service, or its local TV ratings service, Nielsen’s “digital ad ratings (DAR), or Nielsen’s new Nielsen One cross-media measurement service, which all remain unaccredited, although each is also in various stages of MRC audits and reviews.” Nielsen has also begun releasing “impact data” with the Nielsen One transition and “many of its customers will be using that data to plan and buy or sell TV advertising based on that even if that part currently is not accredited.” (MediaPost: 4/18/23)

BOOST IN CTV SPENDING

According to a survey from Digital Remedy, “direct-to-consumer marketers are spending more of their advertising budgets on connected TV and over-the-top”. The report found that 57% of the marketers who bought CTV in the first half of 2023 plan to spend more this year than last year: up from 43% a year ago. The study also found that 65% of the DTC marketers were buying CTV for the first time, and “among those marketers increasing CTV spending, 61% said the ad dollars were coming from other media channels, while 39% said their budgets had been increased, allowing them to spend more on CTV.” Respondents also claimed that CTV was offering more features than other media channels including real-time, automated campaign reporting and optimization. (NextTV: 4/12/23)

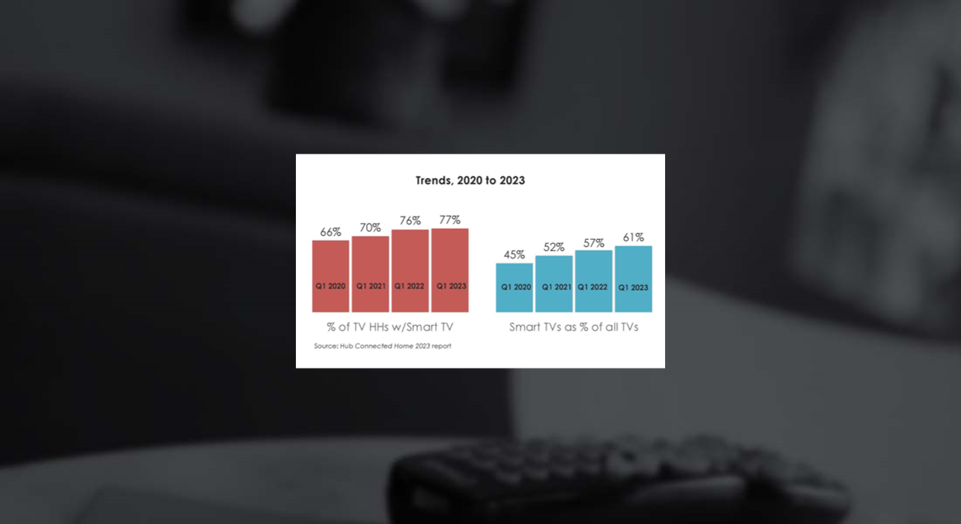

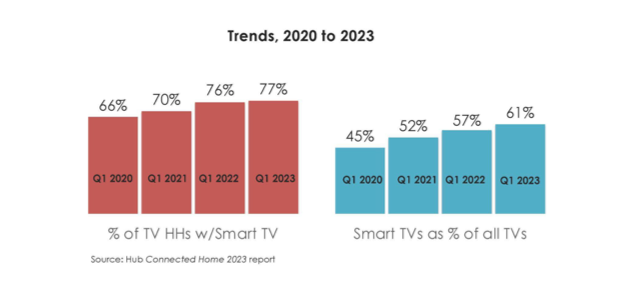

200 MILLION SMART TVs

A study conducted by Hub Entertainment Research found that smart TVs have reached a new milestone, topping an estimated 204 million smart TV sets in American homes. The study found that almost 8 in 10 TV households own a smart TV, up from 66% in 2020. Additionally, more people are using their smart TVs to stream as “almost nine in ten (88%) smart TV homes regularly stream shows through their smart TV’s built-in capability.” (TVTechnology: 4/10/23)