OPEN FOR BUSINESS

TVB updates a document detailing the status of stay-at-home orders for each state, along with brief explanations and how the changes are taking place. There’s also a summary of open dates, stay-at-home order effective date and when each state’s order is set to expire. For more up to date reports between issuances, this resource links to ABC, NBC and NYT.

VIEWERSHIP

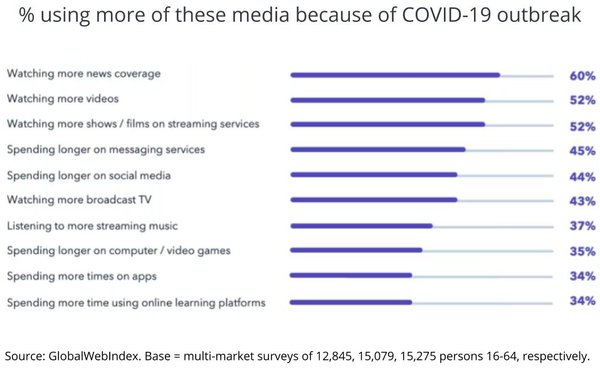

Mediapost (5/20) reported on increases in broadcast TV viewership and a decrease in intended cord-cutting as a result of the pandemic. GlobalWebIndex surveyed over 15,000 people including US viewers, and found results that are consistent across different ages, and even heavy online streamers. While it’s unclear how sustainable the results may be, the experience created new sampling opportunities. In a separate study, Civic Science asked 200,000 US adults about their plans to cut the cable/satellite cord. The percentage of those responding that they’re not interested in cutting the cord increased; indicating a shift towards linear TV.

For the first time since 2011, TV viewership will grow in 2020; up 3% over 2019, according to a new forecast from emarketer (5/18). Of note, some of the largest increases are projected among the young adult demographics, with a +2.8% bump seen for 18-24, +4.3% for 25-34, and +3.1% for 35-44. Similarly, time spent watching TV is on the rise; the first time since 2012 (up 12.6% over 2019). While growth for time-spent (as well as viewership) is expected to stabilize following the relaxing of stay-at-home orders, eMarketer forecasts that 2021 figures will still be higher than 2019, and 2022 will be comparable to 2019.

IMPACT STUDY

Nielsen issued topline findings for week 4 of their COVID-19 Impact Studies Week (5/14). The online survey of 2,739 adults gauged consumer sentiments including contracting the virus (concern for self and others remain high), economic impact (still high but with signs of optimism), media (TV, news, social, gaming) & activity changes (online healthcare, workouts and education), and brand response (messaging changes like curbside pickup, employee/community support.)

MESSAGING

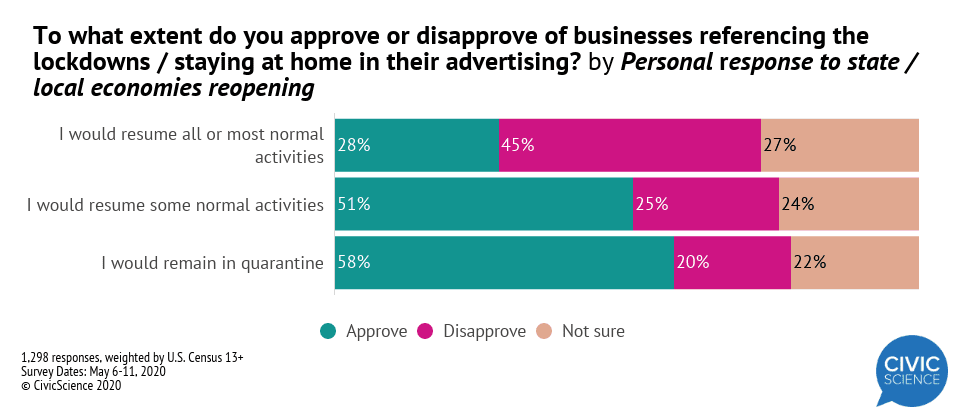

Consumer sentiment for advertising referencing lockdowns or staying at home orders is most correlated with people’s comfort level “going back to the regular day-to-day when lockdowns are lifted.” In a study surveyed last week (5/6-5/11), marketing intelligence company, Civic Science measured “approval/disapproval/ not sure” for age, gender, and employment status as well as industry specific companies like technology, retail, and streaming.

While some may have grown tired of the advertising clichés seen in some pandemic-related commercials, new research from Ace Metrix (AdAge; 5/18) indicates that they’re still effective. While the average “Ace” score for COVID-19 ads peaked at the end of march, the current value is still higher than the average for all ads. One recent stand-out from Unilever includes frontline workers, hopeful music, and features their partnership with Feeding America and Direct Relief.

COMFORT FOOD

Willie Mae’s Scotch House, an honored New Orleans restaurant was featured on GMA (5/19) as part of their “Open for Business” segment, showcasing local restaurants across the country. Famous for their classic American comfort food, they shared their recipe for creamy macaroni and cheese. Also on the GMA website is a link to Auntie Anne’s DIY At-Home Pretzel Kit. A great way to satisfy those cravings for mall food … $20 includes ingredients to make 10 pretzels (just add your own butter.)