Originally posted on MediaVillage

By Daniel Senor, Senior Research Analyst, Strategy, Planning & Insights

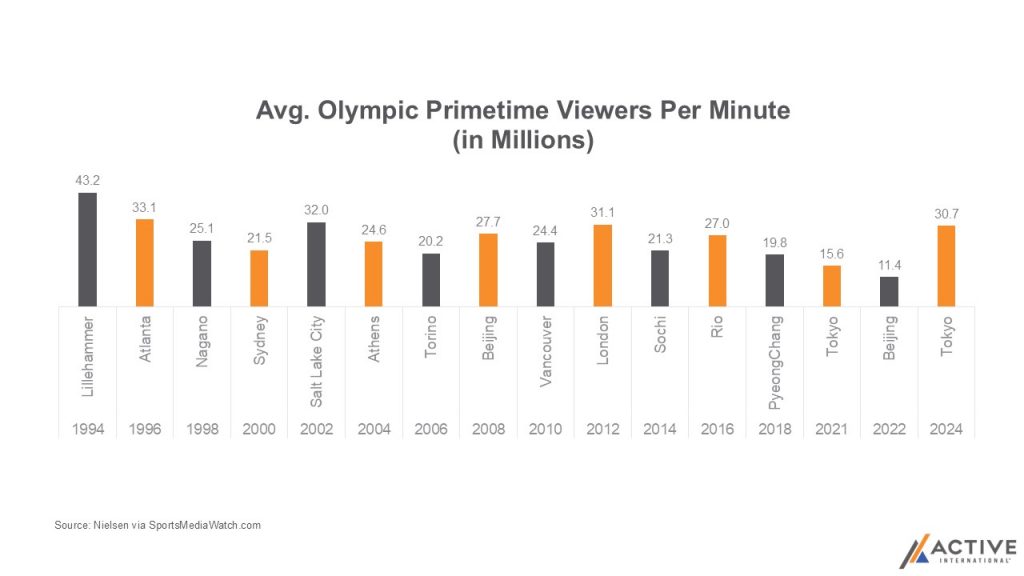

The 2024 Summer Olympic Games in Paris marked a resurgence in “primetime” viewership, with an average of 30.7 million people tuning in across all NBC Platforms (more about why primetime is in quotes a bit later). Nearly twice the viewership average of the 2021 Summer Games in Tokyo (sure, no fans due to COVID-19 restrictions didn’t help), you’d still need to go back to 2012 in London to find an Olympics, Summer or Winter, that was higher rated. Global pandemics aside, there are two key factors influencing this trend reversal, as well as some of the possible reasons NBCU locked in the rights to cover it for years to come.

LOCATION, LOCATION, LOCATION

Looking at the data over the last 20 years, for both the Summer and Winter Games, one of the drivers of US viewership is the time difference between when the games are played live vs. when people in the States are watching. Dating back to the VHS, despite all the on-demand options available across our devices, it’s no surprise that US viewers don’t care to watch replays of sporting events. Live viewership is the draw.

In 2024, live events aired during the middle of the day for most US viewers. For the three preceding Olympics in Beijing (2022), Tokyo (2021), and Pyeong-Chang (2018), given the time difference, most of the events took place while many of us were fast asleep. So, if you weren’t setting your alarm clock to watch Curling at 3AM, you were watching NBC’s rebroadcast during primetime.

PRIMETIME FOR YOU

While time zones are a huge factor in viewership for the Olympics, this year’s games and the changes NBCU made for watching the Olympics were also important. This year marked the first time the Olympics were fully simulcast on linear (NBCU channels) and streaming (Peacock), they also debuted the GoldZone channel on Peacock, which aired daily from 8am-5pm and essentially channel-surfed the Olympics for you. 2024 was also the first games to have their “primetime coverage” in the middle of the day, 2-5pm, in addition to the usual primetime slot of 8-11pm, allowing viewers to either watch live or replay in the same day. It is also worth noting that this change in coverage makes comparing 2024 viewership directly to prior games tricky since those previous games only include 8-11pm viewership (for example, this change now allows for basketball and soccer to be included in primetime viewership, which wasn’t the case previously). Despite the change in measuring viewers, the 2024 games undeniably drew in more viewers to the Olympics since 2012 in London. The change from strictly 8-11pm might have hindered some of the traditional primetime viewing, but the inclusion of 2-5pm paved the way for growth in overall viewership of the games.

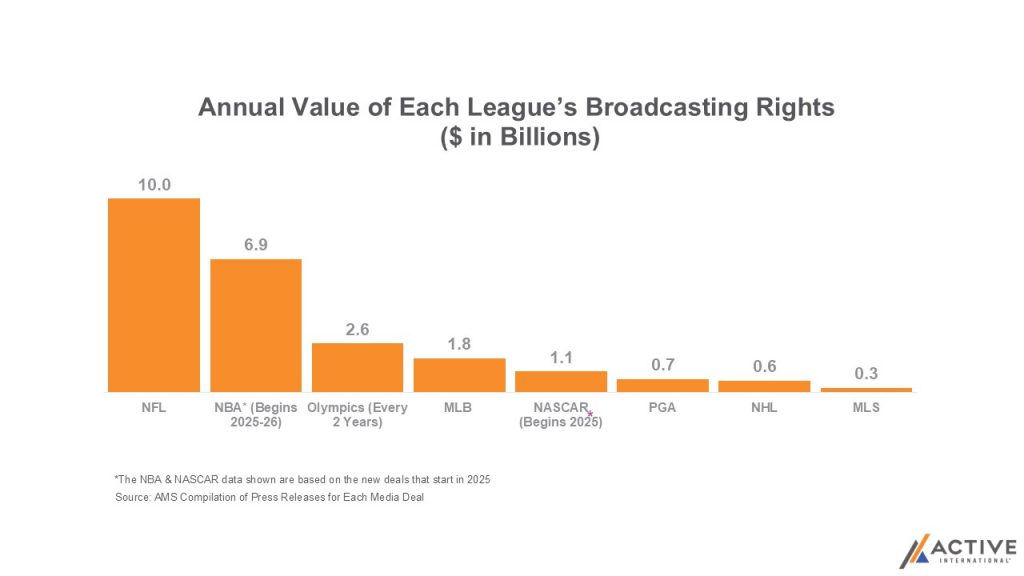

THE OLYMPICS TRAIL ONLY THE NFL AND NBA IN VALUE OF TV RIGHTS

Starting this year, NBCU paid $2.5 billion for this year’s games and will do so for every Olympics through 2032. That cost makes the Olympics the most expensive sporting event outside of the NFL and NBA. Given the investment and the prior two Olympics having all-time low viewership, NBCU had to make some changes in how it approaches its coverage of the games. Based on the 2024 results, it looks like NBCU brought the Olympics back to life. Given that the next three games are in time-zone friendly locations (Italy, Los Angeles, and France) it is reasonable to say that viewership for the Olympics won’t falter until 2032 the earliest, when the games are in Australia.

DEMAND FOR SPORTS, OUTWEIGH SUPPLY: SPORTS RIGHTS ARE BEING PROPERLY VALUED

The Paris Games resulted in significant subscriber growth for Peacock. According to Antenna, Peacock got 2.8 million new subscribers during the first week of the Olympics (July 25th to 31st), which was 6 times higher than Peacock’s 8-week average leading up to the Olympics. Peacock was also responsible for 29% of all new SVOD subscriptions in July. This continues the trend of major sporting events driving new subscribers to streaming services.

This year’s Olympics and its viewership highlight 2 key trends for sports rights and their value to TV:

- Live events draw the most viewers, and sports are one of the last truly live events on TV.

- The streaming wars made sports more valuable since media companies would rather overpay for sports than not have them at all.

- Demand for sports is outpacing the supply of sports that draw in significant viewership.

The panic of not having sports in your content library is leading to massive bidding wars whenever sports rights are up for renewal. Most sport rights are set for the immediate future (UFC and Formula 1 are the only rights expiring after 2025) but there seems to be no slowing down the growth of sports rights.