POLITICAL

AD SPENDING

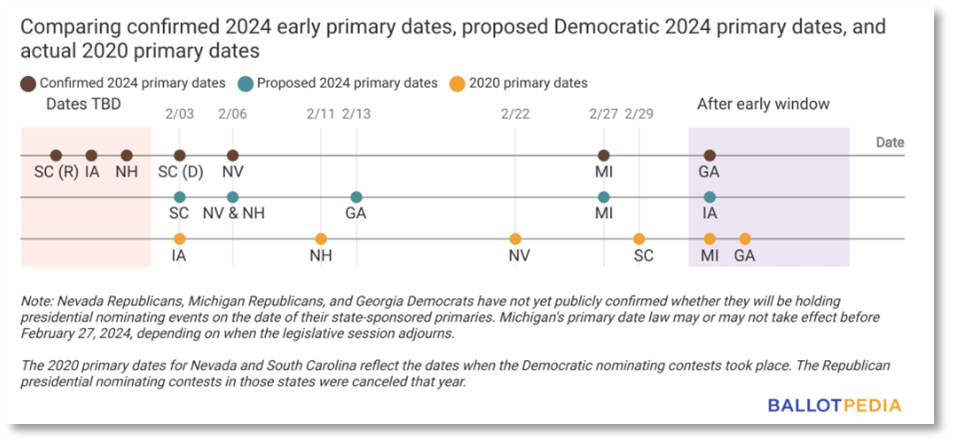

With the 2024 November election just a year and a half away, the calendar for the presidential primaries is beginning to take shape. Ballotpedia provides detail on “the six states where some of the early contests might take place: Iowa, South Carolina, New Hampshire, Nevada, Georgia, and Michigan.” (BallotpediaNews: 5/15/23)

In related news, despite the sluggish ad economy, “political spending is already heating up,” with candidates and campaigns launching their advertising efforts ahead of schedule. Nexstar is experiencing some of the earliest presidential spending in company history with April spending for “Trump, DeSantis, and Biden PACs.” FOX reported “small” but “sort of unheard of” spending this early in the political cycle., while Grey Television announced early spending as well. Political ad experts emphasize the importance of capturing early attention and gaining an advantage in a crowded media landscape. Despite the sluggish overall ad market, political advertising is showing early momentum in the current cycle. (TVNewsCheck: 5/12/23)

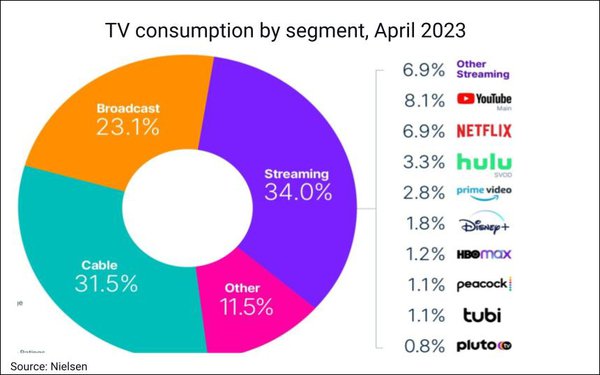

According to Nielsen’s monthly tracking of broadcast, cable, and streaming consumption on TVs, streaming was down 2.1% in April 2023 when compared to March 2023. However, streaming is still the largest share of total hours spent watching TV. Among streamers, FASTs with increased usage included Tubi at 1.1% (up 6% from March) and Pluto TV at 0.8% (up 3.9% from March). “Time spent watching YouTube on television (excluding YouTube TV) rose 1.5% in April, driving a 0.3-point gain in share and maintaining YouTube’s status as the most-watched streaming platform, with an 8.1% share of overall TV viewing.” Netflix was down 7% and lost 0.4 points in share for a 6.9% share of total TV. Disney+ was also down 1.7% in usage but retained its 1.8% share. (MediaPost: 5/16/23)

WAR OF THE FASTs

The recent NewFronts presentations showcased the rapid growth of ad-supported TV platforms, services, and original content. With an increased number of options available, concerns arise regarding the financial viability for individual providers and the potential repeat of the Streaming Wars, albeit an ad-supported version. Companies must avoid chasing scale without a clear value proposition. Success in the ad-supported space requires a new playbook with exclusive programming and robust marketing. While challenges exist, companies like Amazon, Roku, Samsung, and Vizio are investing heavily in the FAST market. To stand out, providers must offer focused programming and employ effective marketing strategies. (NextTV: 4/14/23)

LOCAL CROSS-SCREEN PARTNERSHIP

“In a bid to improve local cross-screen measurement, Cross Screen Media and the ad tracking firm AdImpact have announced they are working together to deliver real-time data on local broadcast advertisements.” AdImpact will provide information on the airing of ads, including the name of the advertiser, station, local market, creative, and the time that the spot aired. This partnership will speed up the measurement of local broadcast ad performance, which means that “advertisers can now understand the precise reach and performance of their campaigns, even before they’re concluded.” (TVTechnology: 5/10/23)